are you a dislocated worker fafsa

Frank Answers your toughest financial aid questions in 60 seconds or lessIf you or your parent lost a job through no fault of your own you may qualify as a. You must still report all income taxed and untaxed.

Everything You Need To Know About Applying For Financial Aid

The student may qualify as a dislocated worker if he or she meets one of the following conditions.

. Knowing what a dislocated worker can help you out when it comes to accurately answering it on the FAFSA. Please check the appropriate box on this form. What is the Fafsas definition of a dislocated worker.

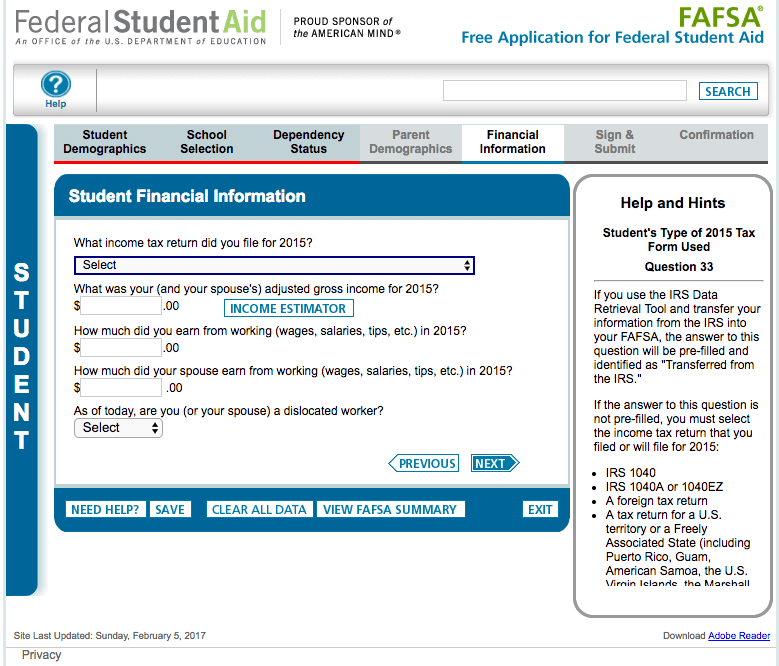

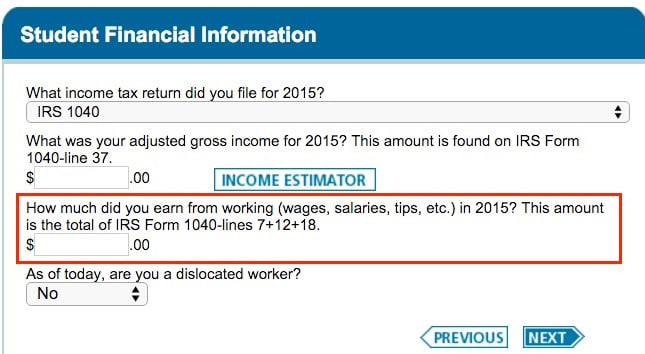

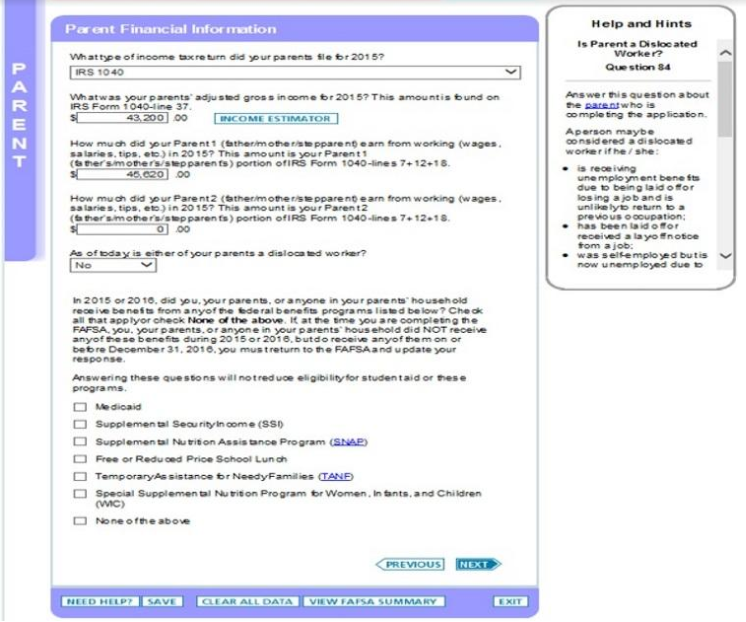

He or she has been laid off or received a. On your FAFSA you answered Yes to the question As of today is either of your Parents or are you or your spouse a dislocated worker. FAFSA has several definitions for a dislocated worker Youre considered a dislocated worker the moment youre laid off.

On the FAFSA dislocated worker may mean several different things. Definition of a Dislocated Worker A person who has been terminated or laid off from work or received a termination or layoff notice as a. Yes means that the student or the students spouse is a dislocated worker as of the date the FAFSA was completed and the student may qualify for the simplified needs test or for an.

A dislocated worker qualification can lower your EFC and raise the amount of your federal aid award. There are several situations when the person is qualified as a dislocated worker at FAFSA. Federal Student Aid.

You are considered a dislocated worker if you. Steve123 January 30 2011 659pm 34. Dislocated workers are people who lost or quit their jobs unexpectedly or due to.

Yes means the students parent is a dislocated worker as of the date the FAFSA was completed and the student may qualify for the simplified needs test or for an automatic zero Expected. Have been laid off. Youre also a dislocated worker if youre still.

This means any unemployment. Image courtesy of The Labor Tribune. A dislocated worker qualification can lower your EFC and raise the amount of your federal aid award.

Firstly it refers to those who are currently receiving unemployment benefits. Are a displaced homemaker stay-at-home student who. Are receiving unemployment benefits as a result of being laid off.

Have you ever heard of a. Before you answer you will need to check with your parents or guardians to confirm their job status. If a person quits work generally he or she is not considered a dislocated worker even if for example the person is receiving unemployment benefits.

Parents Adjusted Gross Income. The student for whom the FAFSA is being completed or their parent s can be a dislocated worker. You must still report all income taxed and untaxed.

He or she has lost hisher job.

A Fumble On A Key Fafsa Tool And A Failure To Communicate The New York Times

Does Being A Dislocated Worker Affect Fafsa Zippia

Financial Aid Ultimate Guide On Getting Money For College Supermoney

Fafsa Updates And College Financial Aid Information Collegiateparent

Early Awareness The Financial Aid Basics Ppt Download

Fsa Training Conference Program Information

Does Being A Dislocated Worker Affect Fafsa Zippia

An Employment Benefits Guide For The Worker In Transition Division Of Workforce Development And Adult Learning

Welcome To Alaska College Goal Sunday Ppt Download

A Fumble On A Key Fafsa Tool And A Failure To Communicate The New York Times

How To Answer Fafsa Question 97 Dislocated Worker Status

What Is Work Study A Student S Guide Nerdwallet

What Is A Dislocated Worker On The Fafsa Frank Financial Aid

Finding Money For College January 8 We Will Talk About Federal Student Aid State Student Aid Student Aid From Colleges Scholarships From Other Ppt Download

Filling Out The Fafsa Form Free Application For Federal Student Aid Dummies

Everything Federal Student Aid

Everything You Need To Know About Applying For Financial Aid